2020 Data. Strong impact of Coronavirus on the Spanish automotive suppliers

According to the data presented by the Spanish Association of Automotive Suppliers (SERNAUTO), in 2020 the Spanish automotive components industry suffered a setback in all its indicators, as a result of the crisis caused by the Coronavirus pandemic at a global level.

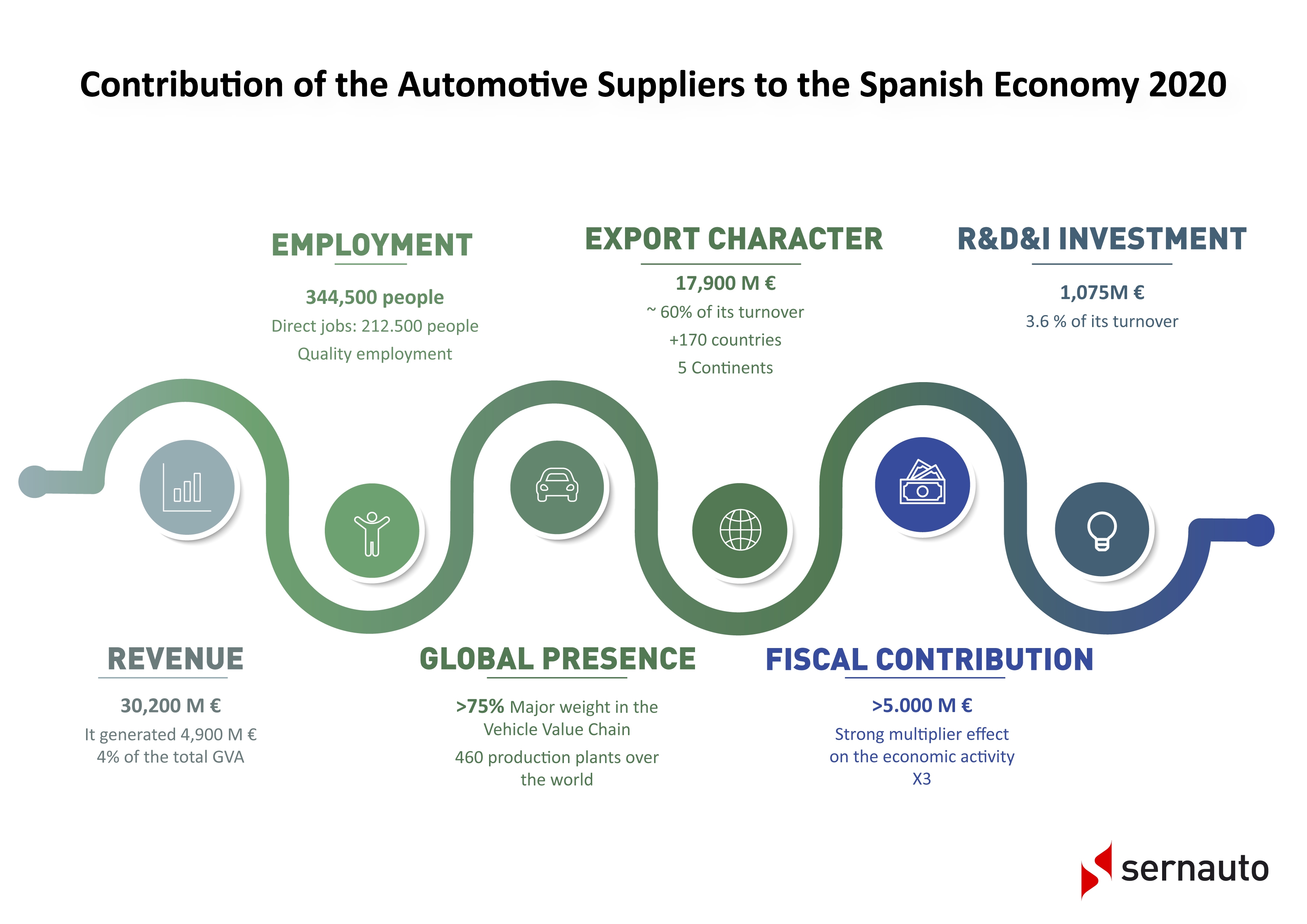

The automotive suppliers sector had a turnover of 30.2 billion euros, which is 15.7% less than in 2019. Although the reduction has been smaller than expected and lower than the fall in vehicle production, it is a step back to figures prior to 2015.

Despite the complex situation experienced in 2020, suppliers continued to allocate a high level of investment to R&D&I in order to face with guarantees the industrial change and continue at the forefront of technology. In 2020, they invested 3.6% of their turnover in R&D&I, i.e., a total of 1.07 billion euros. This is three times the average of the industry.

In 2020, the sector employed a total of 344,500 people (directly and indirectly). Direct employment generated by the sector amounted to 212,500 jobs, 5.7% less than in 2019. This direct employment is characterised by being stable, high-quality and spread throughout Spain. In fact, it represents more than 10% of the industrial employment in several Autonomous Communities.

The effort of this industry to remain competitive and adapt to the needs of its customers can be seen in the fact that in 2020 they invested 1.34 billion euros to increase and improve their productive capacities, which implies 29.6% less than in 2019.

In 2020, the sector exported some 17.9 billion euros, 13.8% less than in 2019, as a result of the severe drop in the global trade of automotive products caused by COVID-19. Exports account for almost 60% of the sector's turnover. This strong export-oriented nature has prevented the fall in turnover from being greater.

Out of the turnover in the domestic market (12.3 billion euros), 7.74 billion euros concern the supply of equipment and components to vehicle manufacturers (-21.0%) and 4.56 billion euros come from the spare parts market (-13.5%).

María Helena Antolin, President of SERNAUTO, says: «these data show the strong impact that the pandemic has had on our industry. We have had to make great efforts, like many other companies, to adapt to the situation and try to maintain production and most of the jobs. This, together with the industrial and technological transformation that we are facing, means that our sector is going through a complex time and that the support of the Administration is more necessary than ever for our country to continue being a benchmark in the automotive industry", she concluded.

Forecasts for 2021

According to the first estimates of SERNAUTO’s Board of Directors, in 2021 the turnover will increase by around 10% compared to 2020, but predictably pre-pandemic levels will not be recovered until 2022.

As regards employment, it is estimated that suppliers will maintain the 2020 job figures.

José Portilla, Managing Director of SERNAUTO, highlights that “as evidenced in our Strategic Agenda 2025, the automotive supplier industry is going through a critical time for its future. The 2020 data show the need to strengthen the entire automotive value chain, for which having European funds will be vital. The sector is synonymous with innovation and quality employment, a strategic sector for the Spanish economy and society, which we must all take care of and support together".

Related content